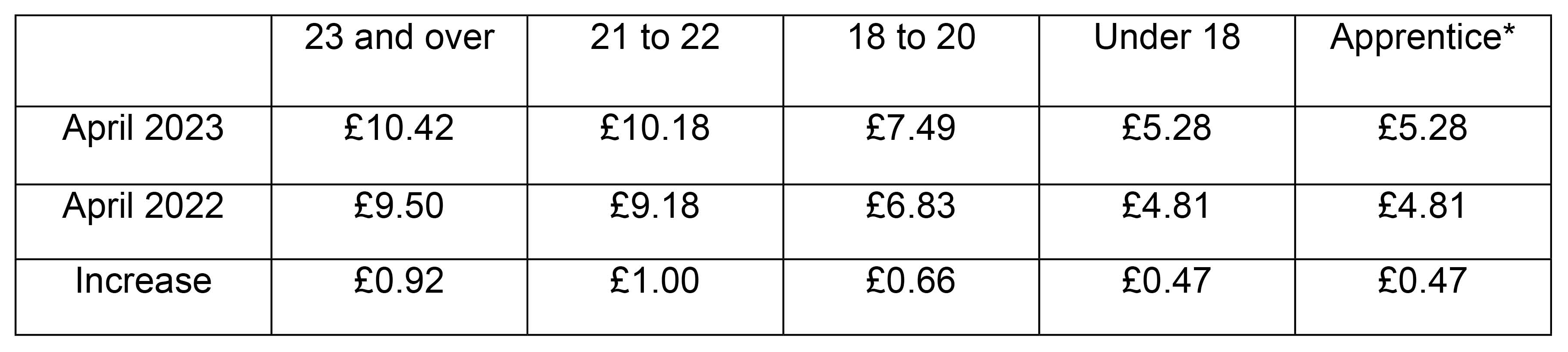

The hourly rate for minimum wage depends on the employees age and the new rates from 1 April 2023 are set out in the table below and apply to the first pay day on or after that date –

*Apprentices are entitled to the minimum wage for their age if they are both aged over 19 and have completed their first year of the apprenticeship

Where an employee is paid a salary, you must ensure that they are being paid the National Minimum or National Living Wage based on their contracted hours. For example, an employee aged over 23 must receive the minimum £10.42 per hour and this equates to £20,319 per annum based on at 37.5 hour working week.

Personal Allowance

The Employee personal allowance for tax year ending 5 April 2024 remains unchanged at £12,570 for all the United Kingdom countries. The tax rate bands do vary for employees living in Scotland and Wales so please ensure your payroll records have the most up to date addresses for all your employees.

Health and Social Care Levy

In September 2022, the then Chancellor Kwasi Kwarteng announced the 1.25 percentage point increase in NICs would be reversed from 6 November 2022 and the Health and Social Care Levy Act 2021 would repealed.

Statutory Payments

The increased rates from 6 April 2023 are:

Workplace Pension Contributions

Every year, the Department for Work and Pensions (DWP) reviews the earnings thresholds for Automatic Enrolment. The 2023/24 level of qualifying earnings remains unchanged at £6,240 per annum. The earnings trigger for automatic enrolment also remains unchanged at £10,000 annually. The total minimum contributions of 8% with the employer contribution being a minimum of 3% and the employee rate of 5% stays the same as the rates for 2022/23.